Politics

5 Ways Trump’s Comeback Is Hitting Your Wallet

By Jake Beardslee · July 27, 2025

The Trump Economy Returns: What’s Changed in Just Six Months

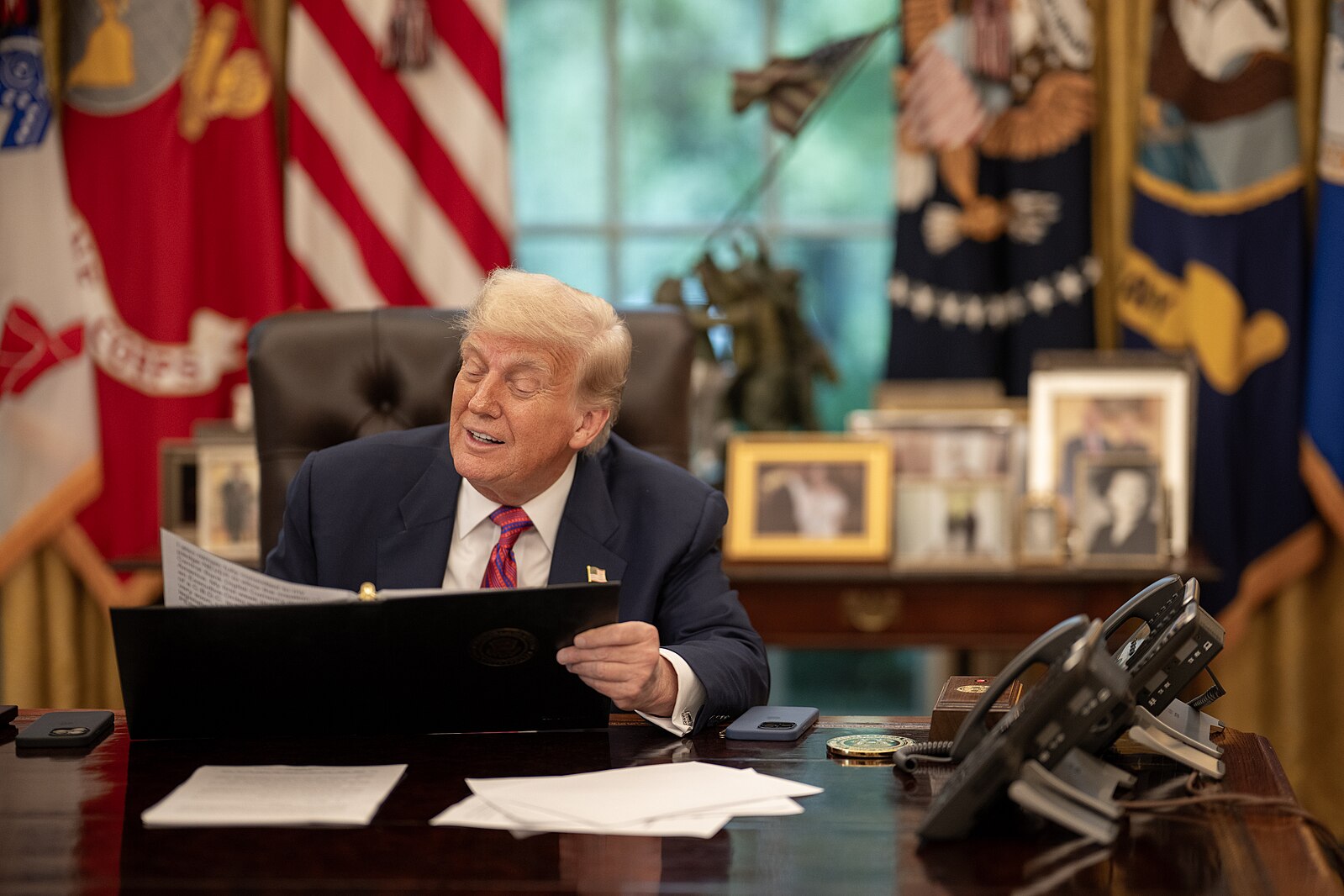

Six months into his second term, President Trump is making his economic agenda felt across nearly every sector of the U.S. economy. From aggressive tariff hikes to sweeping tax cuts and high-stakes battles with the Federal Reserve, Trump’s latest turn at the helm has triggered market shocks, fiscal uncertainty, and renewed debates about growth, equity, and monetary policy.Here are five defining shifts under his economic leadership so far. The White House / Wikimedia

1. Trade War 2.0: Tariffs Surge, China Targeted

Trump has dramatically escalated the trade strategy he launched in his first term, pushing U.S. tariff levels to heights not seen in nearly a century. Tariffs on Chinese goods now sit at roughly 50 percent, raising concerns over a deepening economic rift between the world’s two largest economies. While deals with countries like Japan, Vietnam, and the UK have been floated, details remain thin.The broader U.S. tariff rate is now estimated between 14 and 20 percent, according to Fitch Ratings and Yale's Budget Lab. These hikes appear to be creeping into consumer prices—June's CPI rose to 2.7 percent from 2.4 percent in May. Economists warn this could stoke stagflation, as GDP fell in Q1 and growth is forecast at 2.4 percent for Q2. Manufacturing jobs remain flat at 12.8 million, while wage growth dipped from 4.2 percent in February to 3.9 percent in June. Kaboompics.com / Pexels

2. Tax Cuts 2.0: A Massive, Controversial Overhaul

Earlier this month, Trump signed into law $4.5 trillion in tax cuts—largely extending his 2017 policies. The legislation sailed through Congress faster than analysts expected, though at significant cost: it’s projected to add $3.4 trillion to the national debt (excluding interest), which now totals around $36 trillion.Critics point to minimal projected growth—just 1.8 percent—while the law is expected to remove 10 million Americans from public health coverage. The 2017 tax cuts only raised real wages by 1.2 percent, according to the Congressional Research Service. Nataliya Vaitkevich / Pexels

3. Market Volatility: Stocks Rebound, Bonds Waver

Financial markets initially faltered amid Trump’s aggressive tariff announcements but have since bounced back. The S&P 500 recently hit all-time highs after a rebound in investor confidence, particularly following trade deal headlines. However, the gains are largely concentrated among wealthier Americans—the bottom 50 percent own just 1 percent of U.S. stocks.Bond markets remain shaky. A spike in yields earlier this year rattled the White House, prompting a brief softening of trade rhetoric. While consumer sentiment has partially recovered from tariff-related lows, business confidence continues to wane. The Fed’s latest anecdotal survey is filled with concern over policy unpredictability, and cryptocurrency legislation has further roiled investor nerves. Tima Miroshnichenko / Pexels

4. The Dollar’s Decline: A Strategic Weakening?

Since Trump returned to office, the U.S. dollar has dropped 11 percent on the DXY index, falling from 109.4 to 97.3. This slide defies conventional expectations, especially amid rising tariffs. Trump, however, has leaned into the trend: “I’m a person that likes a strong dollar, but a weak dollar makes you a hell of a lot more money,” he said Friday.Top White House economists argue that devaluation could improve trade balances and revitalize U.S. exports. Some liken the trend to the 1985 Plaza Accord, which intentionally weakened the dollar to reduce the deficit. Vanguard analysts recently declared the dollar “firmly back within our estimated fair-value range.” Kaboompics.com / Pexels

5. Pressure on the Fed: Independence at Risk?

Trump has launched sustained attacks on the Federal Reserve and Chair Jerome Powell, reportedly even floating Powell’s removal to GOP lawmakers. Though unlikely to act, the rhetoric is reshaping how markets perceive Fed independence. Economists fear that continued pressure could erode the Fed’s autonomy and lead to financial repression, where inflation exceeds interest rates and erodes capital returns.Some conservative voices are calling for a reexamination of the 1951 accord separating Fed and Treasury roles. Former Fed Governor Kevin Warsh has suggested a “new accord” that would unify messaging on balance sheet decisions. Such shifts could alter the foundational relationship that has governed U.S. monetary policy for decades. Kaboompics.com / Pexels